Around seven months ago Covid-19 caused a pandemic that gave the world economy its biggest shock since World War II. The labour market completely imploded due to a major slump in consumer spending thanks to lockdown measures, and nearly 500m full-time jobs seemed to vanish overnight. World trade suffered as countries closed their borders and factories were shut down. We would have seen a complete economic collapse if it weren’t for the unprecedented interventions by government aid to failing firms and the labour force, central banks in the financial markets and budget deficits expanding close to what they were during the war.

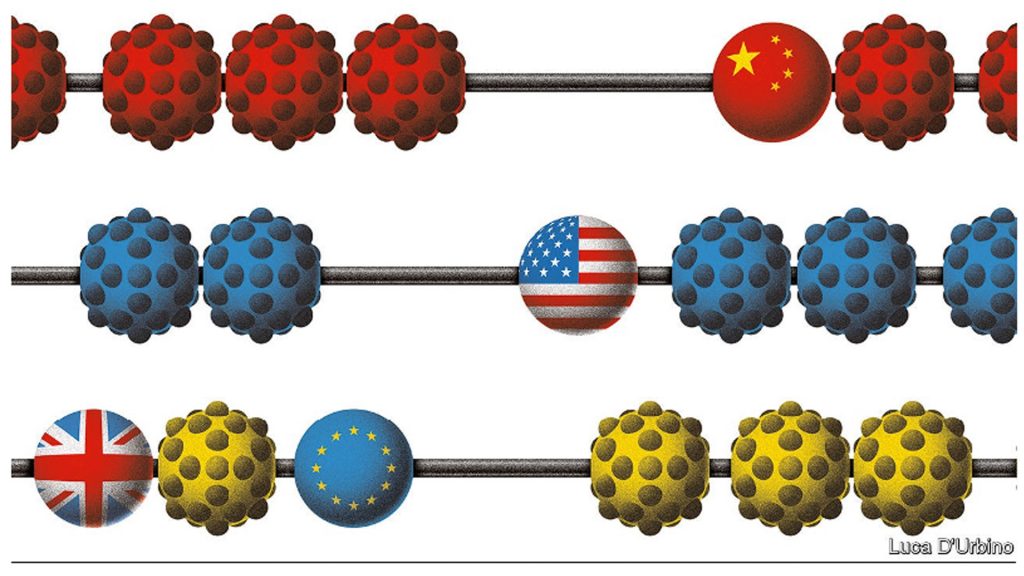

The economy of countries all over the world crashed simultaneously as markets responded to the devastation that coronavirus brought. However, countries are now in recovery mode and preparing for the future, but at completely different rates. There are huge gaps between the performance of countries which could change the world’s economic order. According to forecasts by the OECD, America’s economy won’t have changed from what it was in 2019, but China’s will be 10% bigger. Europe and Japan are suffering a demographic squeeze and continue to perform below pre-pandemic levels, and it’s not looking likely to change for several years.

Why is there such a variation between countries?

UBS bank released a report showing that in the second quarter of this year, the distribution of growth rates across 50 different economies was the widest it’s ever been for at least 40 years. This variation is largely due to how economies are responding to the virus.

China were originally looked down upon with how they handled the virus, but now they have it under control and life is getting back to normal for them. However, Europe and America look like they will deal with a second wave, which could be very costly for their economies. For example, Madrid has now gone into a partial lockdown and Paris has closed its bars – there are talks about the UK entering a second full lockdown too. However, in China, people are downing sambuca shots in nightclubs, and their coronavirus numbers are lower than ours.

Another factor affecting how countries are dealing with the coronavirus is the pre-existing structure of their economies. For example, manufacturing makes up a bigger proportion of China’s economy than in any other major country. It’s much easier to operate factories under the social distancing regulations than it is to run businesses that rely on face-to-face contact, such as service-sector businesses.

A third factor is the country’s policy response – how the government responds to the destruction and the structural changes that the pandemic is causing. Here, size comes into play: America has injected a larger stimulus package into their economy compared to Europe, spending 12% worth of GDP and cutting 1.5% off short-term interest rates. With all these discrepancies, the world economies will continue to diverge.

The Economist has released a special report which explores the global economies in further detail, explaining that these adjustments will be immense. Economies will become more digitised and a lot less globalised and definitely less equal. While working from home is encouraged, workers who were in lower-paid service jobs such as waiters, sales assistants and cleaners will need to find new jobs out in the suburbs. However, with the current job shortage, they could face a long period of unemployment. In America, despite the headline unemployment rate falling, permanent job losses are mounting fast.

What does the future global economy look like?

With companies trying to adapt to the current climate, more activity is moving online and there is a digital surge in the banking industry. Technology was already heading in that direction, but this year, technology stock has completely boomed and it gives a sense of what is coming. Firms with the most advanced IP and the biggest data repositories will dominate the market, and even if economies remain weak, the low interest rates will keep asset prices high. The Economist released an interesting piece on Ant Group and how fintech is revolutionising finance.

China does not seem to face these problems as they have emerged from the pandemic the strongest, at least for now. Later this month, China’s leaders will be agreeing their 5-year plan which will enact Xi Jinping’s model of increasing self-sufficiency and high-tech state capitalism. However, coronavirus has exposed the flaws in China’s economic responses, as they have no safety-net and the stimulus packages the government offered were focused on infrastructure investment rather than supporting household incomes. The high level of state control and surveillance made brutal lockdowns possible, but in the long-run, it’s likely to stunt innovation since people are not able to move or make decisions freely, thereby dampening living standards.

Europe is the one trailing behind – its response to the pandemic is posing a risk to the economies there, as they are not letting them adjust to the situation. In the five biggest economies in Europe, 9% of the labour force are still on furlough. In Britain, the stats are twice as high. All across the continent we are seeing tacit forbearance by the banks, a multitude of discretionary state aid, suspended bankruptcy rules… all basically prolonging the inevitable. Firms which are essentially dead are surviving as zombies at the demise of the taxpayers who will be responsible for paying back this debt at a later date. This is even more worrying when we realise that Germany and France were already promoting national champions in an industrial policy before the pandemic. If Europe continues to support businesses in this way rather than allowing them to fail, its long-term decline could accelerate rapidly.

America is the one we’re not sure about; they seemed to get the policy balance roughly right for most of the year. It wisely allowed the labour market to adjust, bailing out firms less frivolously than Europe, and cast a much more generous safety net for the jobless and provide a larger stimulus package for all. As a result, America is already seeing many new jobs being created, unlike Europe.

However, America’s weakness is the divided and toxic politics. This week, President Trump abandoned talks over renewing the stimulus, potentially pushing the economy over a fiscal cliff. Critical reforms are impossible while the Democrats and Republicans go head-to-head, branding compromise as a weakness. After the election is over, we may see things settle, but it’s likely that there will still be some political backlash affecting policy for many months to come. COVID-19 has disrupted global economy and is calling for a new reality to be set. Every country needs to adapt, but America faces a dilemma; will it be able to lead the post-pandemic world? If it wants to, it needs to put aside the politics and focus on what’s best for the economy